Global yields continue to rise. One of the catalysts was the stronger-than-expected private sector employment level reported by ADP (324,000 versus expected 190,000 and previous 455,000). The robust ADP data increase the likelihood of more positive employment data on Friday, which overall supports the US dollar.

The second reason is the quarterly refinancing plan by the Treasury Department. Offering $1 trillion in bonds indirectly indicates tax problems and a growing gap between expenses and revenues. The Congressional Budget Committee predicts economic growth slowdown and an increase in unemployment levels, with improvements expected once the Federal Reserve starts cutting rates. Until then, the budget deficit is being managed by increased borrowing.

As a result, risk assets are under pressure. The dollar appears strong, and there are no immediate reasons to expect its weakening in the short term.

USD/CAD

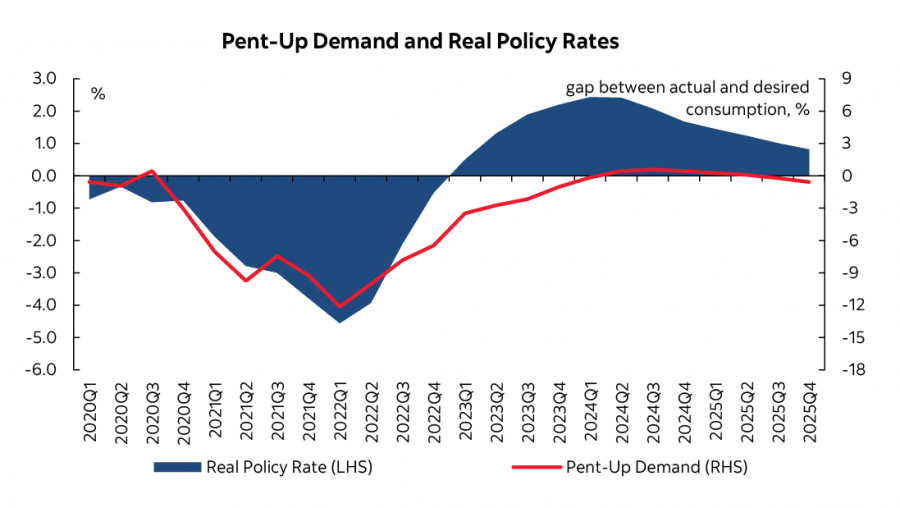

The Canadian economy looks resilient amid the threat of rapid interest rate hikes, and this resilience, according to Scotiabank analysts, is attributed to a high level of pent-up demand – the gap between actual and desired consumption.

During the pandemic, the gap between actual and desired consumption increased due to low interest rates, easy access to credit, rapid labor market recovery, and record-low unemployment levels on one hand, and supply constraints on the other. This gap has not been eliminated despite all efforts by the Bank of Canada to slow down economic growth, and deferred demand persists.

To eliminate the pent-up demand, a period of sustainable positive interest rates is needed, which is still problematic in the conditions of high inflation. Consequently, the Bank of Canada needs to continue efforts to slow down inflation, which means continuing to raise rates until the pent-up demand is eliminated. This necessity provides grounds to assume that the yield spread in favor of the Canadian dollar will be maintained for a considerable time, ultimately supporting demand for the loonie and raising its market value.

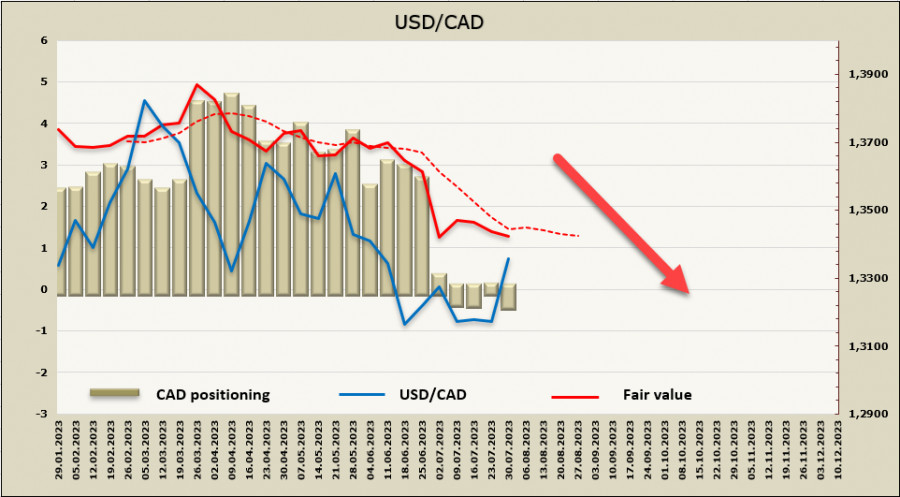

The cumulative long position in CAD increased by 380 million during the reporting week, reaching +420 million, and positioning remains neutral with a slight bias in favor of the Canadian dollar. The calculated price is still pointing downward and is below the long-term average, indicating that the current rise in USD/CAD is likely corrective.

Large-scale USD purchases also affected USD/CAD, with the rise being limited by resistance at 1.3375/85, where a downward reversal is likely. If the resistance does not hold, the next resistance zone is at 1.3450/70. We expect that the bullish impulse will soon complete, and the pair will resume its decline, with the long-term target remaining in the strong support zone at 1.3000/20.

USD/JPY

The Bank of Japan made adjustments to its Yield Curve Control (YCC) program, making it more flexible. The target range remained unchanged at +/- 50 basis points, but the boundaries of the range are now considered as targets rather than rigid constraints.

This adjustment aims to enhance the sustainability of monetary policy easing while acknowledging issues related to rising inflation and global interest rate trends. Essentially, this means that the central bank is ready to allow 10-year JGB yields to rise above 0.5% and even reach 1.0% if market conditions require it. However, considering that the demand for JGB bonds from domestic investors is high, the yield on JGBs is unlikely to rise to 1%, unless it is driven by a rise in US yields.

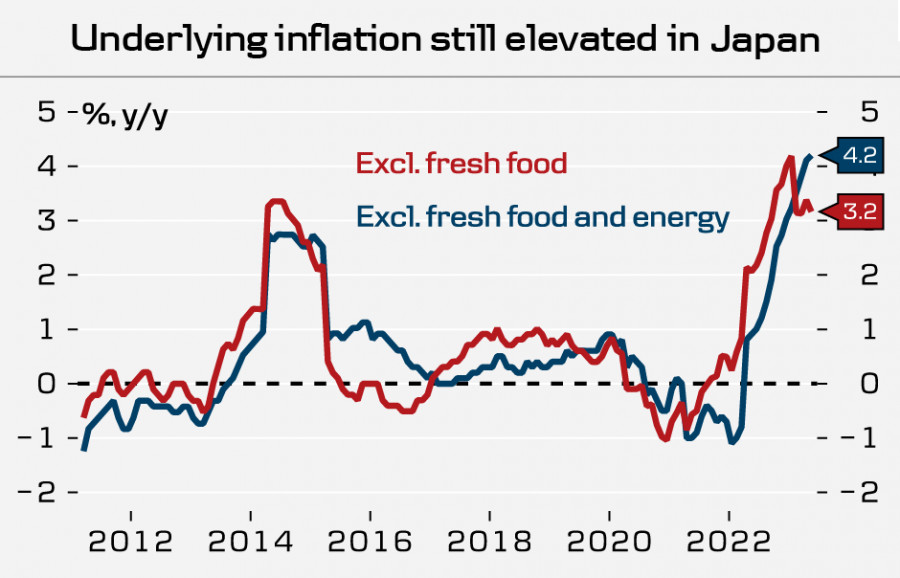

BOJ Governor Kazuo Ueda emphasized during the press conference that this adjustment should not be interpreted as a tightening of monetary policy. He stated that stable inflation with wage growth has not yet been achieved, and the central bank is ready for further easing if necessary.

The BOJ also revised its inflation forecasts in the outlook report, indicating an increase, particularly raising the median core CPI forecast for the 2023 financial year to 2.5% from 1.8% in April.

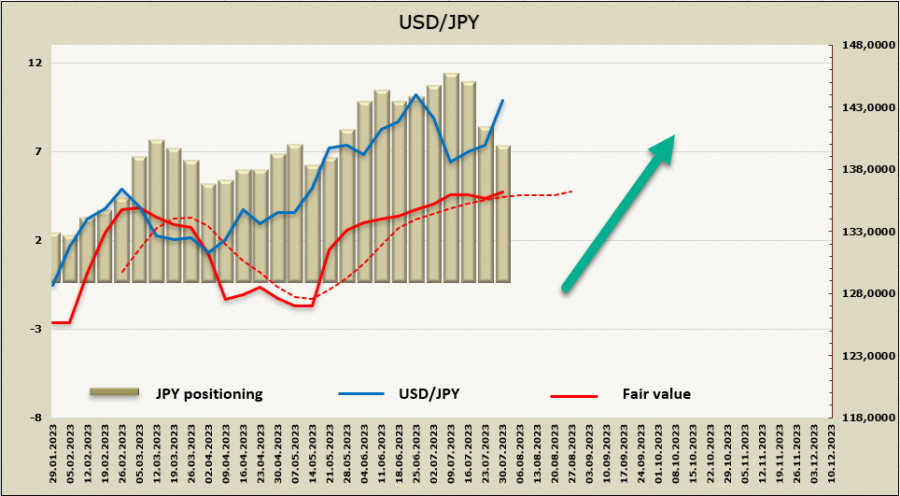

What do the outcomes of the BOJ meeting mean for the yen? If yields start to rise, the yen may receive an incentive to strengthen, especially amid the approaching peak of global interest rates. It is still too early to talk about a downward reversal in USD/JPY, but if the CFTC report next Friday shows a further reduction in short positions on the yen, it will likely indicate the beginning of a reversal.

The net short position on the yen has noticeably decreased for the second consecutive week, this time by 1.227 billion, with the overall bias still in favor of the dollar, and at the end of the reporting week, it amounted to -6.898 billion. Despite the correction in futures market positions, the calculated price managed to stay above the long-term average.

A week ago, we assumed that trading in USD/JPY would primarily occur within a sideways range, but the unmet expectations after the BOJ meeting and the overall rise in demand for the dollar allowed another bullish impulse to form. The nearest target is 145.06, and an update of the local high will strengthen the bullish momentum, with the target shifting towards the upper band of the channel at 147.30/70.